The odds of hitting a deer with your vehicle in the United States has increased this year over last year, according to a State Farm claim analysis. As reported in Claims Journal, U.S. drivers are 3% more likely to collide with a deer in the next 12 months than they were last year. That makes the odds of hitting a deer 1 in 169 nationally. In Connecticut, drivers are 20% more likely to hit a deer this year than last, with the odds being 1 in 256, according to the ctnews.com Connecticut Postings blog. State Farm ranks Connecticut as 36th in the country for the most deer collisions. West Virginia and Pennsylvania are ranked 1st and 2nd with odds being 1 in 39 and 1 in 71, respectively.

State Farm also reports that the national cost per claim for a vehicle-deer collision is $3,888, up 13.9% from 2013, when it was $3,414. And the months a driver is most likely to hit a deer are October, November, and December due to mating and hunting seasons.

September 30, 2014

New Report: School Bus Driver Licensing and DUI Suspensions

OLR Report 2014-R-0243 summarizes laws that govern the service of civil restraining orders in New England, New Jersey, and New York. The specific issues are:

- who is authorized to serve an order and is service required within a certain timeframe,

- what are the acceptable forms and methods of service,

- is service tracked or monitored,

- who funds the fees paid to agents who serve orders, and

- whether law enforcement and the applicant are notified of (a) service and (b) issued or vacated orders?

In a majority of the eight states, law enforcement agents are the agents authorized to serve process. Also, in most of these states, process must be served in person and a copy of the notice is generally an acceptable form. The New Jersey, New York, and Rhode Island statutes specify acceptable alternative methods and forms of service, such as mailing the notice to the respondent or publishing it in a newspaper. The time allowed to serve process varies from “immediately” to a specified amount of time before a hearing on the application, such as five days.

At least five of these states (Connecticut, New Hampshire, New Jersey, New York, and Vermont) statutorily require use of a computerized registry or database to track restraining orders. Only Connecticut’s statute specifies who funds the service of process fees (the Judicial Branch). In most of the states, the court is required to notify applicants of orders issued, but Rhode Island is the only state that requires the authorized agent to notify the applicant of return of service. Connecticut is the only state that requires the court to notify the school, college, or university the victim attends if he or she requests it. New York allows the clerk to file a copy of the order with the sheriff’s office or police department in the county or city where the victim attends school.

For more information, read the full report.

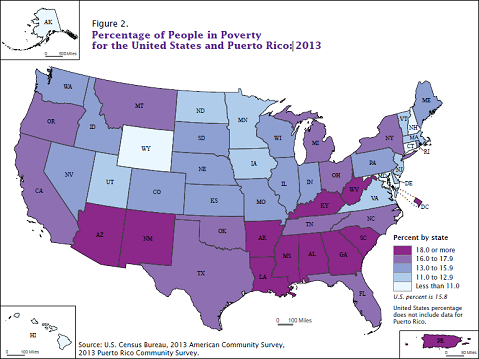

Nationally, Poverty Rate Down (Slightly)

According to the U.S. Census Bureau, as reported by the Washington Post, the poverty rate decreased slightly, from 15% in 2012 to 14.5% in 2013, but the number of people living at or below the poverty line remained stable. The Bureau attributed these seemingly incongruous results to population growth.

According to the article, the poverty rate decrease was due at least in part to more workers shifting from part-time to full-time employment.

Additionally, from 2012 to 2013, the Bureau reported that the Connecticut poverty rate held steady, at 10.7%. In 2013, Connecticut’s poverty rate was the fourth lowest in the country, behind Maryland (10.1%), Alaska (9.3%), and New Hampshire (8.7%).

The map below has more information about poverty rates across the country.

According to the article, the poverty rate decrease was due at least in part to more workers shifting from part-time to full-time employment.

Additionally, from 2012 to 2013, the Bureau reported that the Connecticut poverty rate held steady, at 10.7%. In 2013, Connecticut’s poverty rate was the fourth lowest in the country, behind Maryland (10.1%), Alaska (9.3%), and New Hampshire (8.7%).

The map below has more information about poverty rates across the country.

Source: US Census Bureau, Poverty: 2012 and 2013

September 29, 2014

Redefining “Minority Student” In Public Education

The oxymoron “majority-minority” best describes the United States public school population for the 2014-15 school year. The Pew Research Center reports that U.S. Department of Education numbers show Caucasian student enrollment being surpassed by the combined total of non-white students for the first time this fall.

Pew reports that two groups, Hispanics and Asians, have experienced overall population growth. This is due to an increase in the number of U.S.-born children in these racial groups, rather than immigration. The proportion of black students attending public school this fall is expected to remain the same. Overall, white students still outnumber any other individual race in enrollment rates.

Conversely, the racial breakdown of private school students is predominantly white. In private schools serving grades kindergarten through 12, approximately seven out of 10 students were white, according to 2009 data from the National Center for Education Statistics.

Pew reports that two groups, Hispanics and Asians, have experienced overall population growth. This is due to an increase in the number of U.S.-born children in these racial groups, rather than immigration. The proportion of black students attending public school this fall is expected to remain the same. Overall, white students still outnumber any other individual race in enrollment rates.

Conversely, the racial breakdown of private school students is predominantly white. In private schools serving grades kindergarten through 12, approximately seven out of 10 students were white, according to 2009 data from the National Center for Education Statistics.

|

| Source: Pew Research Center |

Seasonal Patterns to Criminal Activity?

A recent study from the federal Bureau of Justice Statistics looks at crime rates and victimizations by season from 1993 to 2010. The study finds that:

- seasonal differences in household property victimization (burglary, motor vehicle theft, and household larceny) varied by less than 11% and violent victimizations (sexual assault, robbery, aggravated assault, and simple assault) varied by less than 12%;

- rates in household crimes, aggravated assaults, and intimate partner violence were higher in the summer than other seasons;

- simple assaults had higher rates during the fall; and

- robbery rates did not have seasonal variations.

September 26, 2014

Washington Supreme Court Holds State Legislature in Contempt on Education Funding

The Washington State Supreme Court is holding the state

legislature in contempt of court for failing to make enough progress toward

meeting the education funding goals set by the court in an earlier case. The

Seattle Times reports the September 11

decision gives the legislature until the end of the 2015 legislative session to

do better, and the court promises to consider sanctions against the legislature

if the progress is inadequate.

In the decision, the court promises

to revisit the issue next year. “If by the adjournment of the 2015 legislative

session the state has not purged the contempt by complying with the court’s

order, the court will reconvene to impose sanctions and other remedial measures

as necessary,” the decision states. At issue is whether the state has made

enough progress toward fully funding education as required by the court in its

landmark 2012 decision in McCleary v. State of Washington.

At the contempt hearing earlier in September, the justices

were publicly mulling over steps they could take to generate billions more in

education dollars. The Seattle Post Intelligencer reported that the judges

expressed impatience with the state legislature’s efforts to meet the court’s

demands in McCleary.

To create more state revenue for education, Justice Charles

Johnson

offered the suggestion that the justices could declare every state tax exemption

unconstitutional, according to the Intelligencer. He estimated that this could increase

state revenue by $30 billion, which he said was more than enough to pay for

basic education for the state’s public school children. The state’s solicitor

general responded that such a move would be efficient, but probably not

constitutional, according to the article.

Washington is not the only state wrestling with a school

finance lawsuit. As of last December, the National Conference of State

Legislatures (NCSL) identified nine

states (including Connecticut) in the midst of litigation

challenging state school financing systems.

Residential Electricity Prices Increase Nationwide

According to the U.S. Energy Information Administration (EIA), national retail residential electricity prices for the first half of 2014 averaged 12.3 cents per kilowatt hour, a 3.2% increase from the same period last year. In the New England States, rates increased 11.8%, which was the largest increase among U.S. regions. EIA attributes the region’s high rates primarily to a sharp rise in wholesale power prices, noting that the region’s average day-ahead wholesale power price of $93 per megawatt hour was 45% more than it was the year before. Average retail prices in the Pacific region decreased 2.5% due to a one-time credit Californian’s received from the funds raised through the state’s greenhouse gas emissions cap-and-trade system. Excluding the credit, the region’s rates increased 0.9%.

September 25, 2014

Exercise Program Benefits Older Drivers

An exercise program for older drivers helped improve their flexibility, and made it easier for them to turn their heads to look for blind spots, according to a recent study. The exercise program was especially designed to benefit elderly drivers, whose ability to drive safely may be impaired by loss of flexibility and mobility.

According to the Hartford Courant, drivers who exercised for 15 to 20 minutes daily were better able to turn their heads than those who did not exercise. Those who exercised were also better able to turn their bodies to check an intersecting road before turning right, and to enter and leave their cars more quickly.

The study was conducted by The Hartford Center for Mature Market Excellence and the MIT Age Lab.

According to the Hartford Courant, drivers who exercised for 15 to 20 minutes daily were better able to turn their heads than those who did not exercise. Those who exercised were also better able to turn their bodies to check an intersecting road before turning right, and to enter and leave their cars more quickly.

The study was conducted by The Hartford Center for Mature Market Excellence and the MIT Age Lab.

New Report: “Sustainable Jersey” and Similar Programs for Municipalities

OLR Report 2014-R-0227 answers the questions: How is the “Sustainable Jersey” program managed? Who are the stakeholders involved? What is the program’s certification process? What types of actions qualify for certification? What grants does the program offer to communities? Does Connecticut have any similar programs?

“Sustainable Jersey” is a nonprofit organization that, among other things, offers a certification for New Jersey towns that perform various sustainable actions, such as energy efficiency measures, climate change mitigation and planning, or waste management initiatives. Participating towns earn points for each action and are certified after reaching certain point totals and meeting other requirements.

Sustainability is commonly defined as development that meets the needs of the present without compromising the ability of future generations to meet their needs. Sustainable Jersey identifies three concepts as interrelated components of sustainability: (1) supporting local economies and using community resources, (2) practicing responsible environmental management and conservation, and (3) contributing to a strong civil society that provides opportunities for all.

Sustainable Jersey developed as a collaboration between the Sustainability Institute at the College of New Jersey, New Jersey League of Municipalities, New Jersey Board of Public Utilities, and New Jersey Department of Environmental Protection. Task forces, which develop the list of actions towns can take, include representation from academia; the nonprofit sector; the business community; and state, local, federal, and county government.

Towns that wish to obtain certification from Sustainable Jersey must (1) pass an ordinance expressing intent to do so and designating a liaison; (2) establish a commission (i.e., a “green team”) to coordinate efforts; and (3) accumulate points by performing various qualifying actions. Through its task forces and staff, Sustainable Jersey establishes sustainable actions, places them in categories, and designates some as priority actions. To earn bronze certification, a town must earn at least 150 points, perform two priority actions, and perform actions from at least six different categories. Silver certification requires 350 points, three priority actions, and actions in at least eight different categories.

Towns that have registered with the program get special priority access and notification of incentives and grants and are eligible for the Sustainable Jersey Small Grants Program. In 2013, the program distributed 22 “capacity building” grants and 12 larger project-based grants. Municipalities can also access the program’s guidance tools and other resources, such as training workshops, webinars, and leadership meetings. Certified towns receive a customized Sustainable Jersey logo that can be used on the town’s promotional material and are honored at an annual Sustainable Jersey luncheon at the New Jersey League of Municipalities Conference. Annual Sustainable Jersey awards are bestowed to towns that receive the most points or excel in leadership, innovation, and collaboration.

In Connecticut, two programs reward municipalities for various efforts related to sustainability, but they have a more narrow scope than Sustainable Jersey. The Clean Energy Communities program, administered by the Connecticut Green Bank, financially rewards participating communities for taking certain actions to promote greater energy efficiency and more widespread use of clean energy. The Green Circle Award, administered by the Department of Energy and Environmental Protection (DEEP), recognizes local governments, businesses, civic organizations and individuals who have participated in certain energy conservation, transportation, pollution prevention, or recycling-related activities or projects that promote natural resource conservation or environmental awareness.

For more information, read the full report.

“Sustainable Jersey” is a nonprofit organization that, among other things, offers a certification for New Jersey towns that perform various sustainable actions, such as energy efficiency measures, climate change mitigation and planning, or waste management initiatives. Participating towns earn points for each action and are certified after reaching certain point totals and meeting other requirements.

Sustainability is commonly defined as development that meets the needs of the present without compromising the ability of future generations to meet their needs. Sustainable Jersey identifies three concepts as interrelated components of sustainability: (1) supporting local economies and using community resources, (2) practicing responsible environmental management and conservation, and (3) contributing to a strong civil society that provides opportunities for all.

Sustainable Jersey developed as a collaboration between the Sustainability Institute at the College of New Jersey, New Jersey League of Municipalities, New Jersey Board of Public Utilities, and New Jersey Department of Environmental Protection. Task forces, which develop the list of actions towns can take, include representation from academia; the nonprofit sector; the business community; and state, local, federal, and county government.

Towns that wish to obtain certification from Sustainable Jersey must (1) pass an ordinance expressing intent to do so and designating a liaison; (2) establish a commission (i.e., a “green team”) to coordinate efforts; and (3) accumulate points by performing various qualifying actions. Through its task forces and staff, Sustainable Jersey establishes sustainable actions, places them in categories, and designates some as priority actions. To earn bronze certification, a town must earn at least 150 points, perform two priority actions, and perform actions from at least six different categories. Silver certification requires 350 points, three priority actions, and actions in at least eight different categories.

Towns that have registered with the program get special priority access and notification of incentives and grants and are eligible for the Sustainable Jersey Small Grants Program. In 2013, the program distributed 22 “capacity building” grants and 12 larger project-based grants. Municipalities can also access the program’s guidance tools and other resources, such as training workshops, webinars, and leadership meetings. Certified towns receive a customized Sustainable Jersey logo that can be used on the town’s promotional material and are honored at an annual Sustainable Jersey luncheon at the New Jersey League of Municipalities Conference. Annual Sustainable Jersey awards are bestowed to towns that receive the most points or excel in leadership, innovation, and collaboration.

In Connecticut, two programs reward municipalities for various efforts related to sustainability, but they have a more narrow scope than Sustainable Jersey. The Clean Energy Communities program, administered by the Connecticut Green Bank, financially rewards participating communities for taking certain actions to promote greater energy efficiency and more widespread use of clean energy. The Green Circle Award, administered by the Department of Energy and Environmental Protection (DEEP), recognizes local governments, businesses, civic organizations and individuals who have participated in certain energy conservation, transportation, pollution prevention, or recycling-related activities or projects that promote natural resource conservation or environmental awareness.

For more information, read the full report.

Is it Worth Paying Higher Rent to Live in a City with Good Public Transportation?

The Citizens Budget Commission, a New York-based nonprofit that studies state and city government issues, recently released a policy brief concluding, based on an analysis of 22 large cities, that New York, San Francisco, and Washington, D.C., are the most affordable cities in which to live. How can that be? According to the policy brief, these cities’ quality public transportation systems make up for high rents.

The table below shows the average portion of income families spend on housing (blue) and transportation (green) in the studied cities.

The table below shows the average portion of income families spend on housing (blue) and transportation (green) in the studied cities.

|

| Source: CBC Policy Brief |

September 24, 2014

Do Taxes Still Count Among Life’s Two Certainties?

|

| Source: |

"Reform the State’s corporate and bank franchise taxes to better reflect how businesses operate in the 21st century economy and improve business tax incentives so they achieve their economic and social goals at an appropriate cost to the state."

How have business operations changed in the 21st century to warrant this recommendation? One (legal) way some businesses escape the federal government’s tax net is to shift their legal address abroad. “More than 40 U.S. companies have reincorporated in tax havens, a strategy known as inversion, 11 of them since 2012,” according to Bloomberg Businessweek’s Zachary R. Mider (“Big Enough to Drive a Government Contract Through”, July 14-July 20, 2014, available in Legislative Library).

Ingersoll-Rand, a leading energy efficient air conditioner manufacturer, cut its tax bill by changing to a Bermuda address. Ingersoll-Rand’s move was preceded by Tyco International and Accenture, according to Mider, who also noted that “a company that avoids domestic taxes by shifting its address abroad can still be eligible for federal contracts if it has ‘substantial business’ in its new home—thus nominally demonstrating that its move wasn’t solely for tax reasons.” (Mider’s main point was whether these companies should be allowed to bid on government contracts.)

But business strategies aren’t the only forces reducing tax flows. In some cases, reduced tax flows may be the natural outcome of technological improvements. For example, in a recent State Tax Notes article, Texas Deputy Comptroller Billy Hamilton cited sources attributing the drop in motor fuel taxes to the increase in fuel-efficient cars and the fact that people are driving less. (“A Tax Designed to Fail: How Do You Solve a Problem Like the Gas Tax?,” March 3, 2014, available in Legislative Library).

State motor fuel taxes generate about $40 billion a year, and most of the revenue pays for transportation-related improvements. “That’s a big hole to fill,” Hamilton stated. So, what are our options? Get people to switch back to gas-guzzlers?

No one appears to be calling for that, but other options have political pitfalls. As Hamilton notes, “Unlike other major taxes that are levied on a percentage basis, fuel taxes are usually collected as a fixed number of cents on each gallon. They don’t grow with inflation or keep pace with increasing highway costs.” States could increase tax rates, and eight did so in 2013. Another option is shifting the basis of the tax from fuel consumption to the number of miles a vehicle travels, an option that poses political and technical challenges.

Police Dog Memorial Unveiled

According to a Hartford Courant article, the State Police recently unveiled a memorial honoring 80 years of service by State Police dogs. The memorial is located outside the state Department of Emergency Services and Public Protection building in Middletown and was funded through private donations.

The memorial shows a trooper kneeling and hugging a dog and has the inscription, “Dedicated to past, present and future canines of the Connecticut State Police. Their loyalty courage and sacrifice will never be forgotten."

The State Police began using police dogs in 1934, trained them to detect drugs in the 1970s, and became the first police department to train an entire team of detecting dogs in the 1980s.

The memorial shows a trooper kneeling and hugging a dog and has the inscription, “Dedicated to past, present and future canines of the Connecticut State Police. Their loyalty courage and sacrifice will never be forgotten."

The State Police began using police dogs in 1934, trained them to detect drugs in the 1970s, and became the first police department to train an entire team of detecting dogs in the 1980s.

September 23, 2014

Q&A: Driverless Cars

A recent Washington Post article answers 15 questions many people have about driverless cars, including:

- When are driverless cars going to be available? (Likely, sometime between 2025 and 2030.)

- How much will they cost? (Way too much now, but $3,000-$5,000 more than regular cars when they hit mass production.)

- How do they work? (A variety of sensory equipment, as well as GPS and cloud technology.)

- Can they deal with things like pedestrians, work zones, etc.? (Yes, but they could be better.)

- Are autonomous cars the same as connected cars? (No. Connected cars communicate with other cars and highway beacons in order to assist the vehicle’s driver. This technology could make autonomous cars better.)

- Will people ride in autonomous vehicles? (Half of people surveyed by Pew Research said “no.”)

The Human Cost of Excessive Alcohol Consumption

According to a new report from the federal Centers for Disease Control and Prevention (CDC), excessive alcohol consumption is a factor in one out of every 10 deaths of working-age adults. Examining data from 2006 to 2010, researchers found that alcohol caused an average of 87,798 deaths per year, resulting in 2,560,290 years of potential life lost.

The study defined excessive alcohol consumption as:

The Washington Post has more about the study.

The study defined excessive alcohol consumption as:

- binge drinking, or at least five drinks at one time for men and at least four for women;

- heavy weekly consumption, or at least 15 drinks for men and at least eight for women; and

- any drinking by pregnant women.

The Washington Post has more about the study.

September 22, 2014

Receive an Unfamiliar Debt Notice? It Could Be a Scam

A letter arrives notifying you that you need to a pay a debt. There’s the seal of a government agency and it’s signed by a judge. It has your name and address. It looks official.

But hold on: you don’t remember taking out this loan and the name of the government agency doesn’t sound quite right. It could be a scam!

The Federal Trade Commission warns consumers that if they receive a debt notice that doesn’t seem right to look it up on the web. In this instance, search online for the agency’s and judge’s name. They also advise caution if anyone insists on wiring money to pay a debt.

But hold on: you don’t remember taking out this loan and the name of the government agency doesn’t sound quite right. It could be a scam!

The Federal Trade Commission warns consumers that if they receive a debt notice that doesn’t seem right to look it up on the web. In this instance, search online for the agency’s and judge’s name. They also advise caution if anyone insists on wiring money to pay a debt.

September 21, 2014

Feds Seek Proposals for SNAP Pilot Projects

As reported in a recent Governing article, the U.S. Department of Agriculture is seeking state proposals for three-year pilot programs that would associate Supplemental Nutrition Assistance Program (SNAP, or food stamps) eligibility with a recipient’s employment status.

The federal farm bill Congress passed in February included $200 million for (1) up to ten state pilot programs that tied food stamp eligibility to employment and (2) an independent evaluator to test the pilots’ effectiveness.

The article notes that to be eligible for one of the grants, a state’s pilot program must:

According to the article, “[t]he farm bill specifically calls for testing both mandatory and voluntary employment and training programs.”

States must submit their applications by November 14, 2014.

The federal farm bill Congress passed in February included $200 million for (1) up to ten state pilot programs that tied food stamp eligibility to employment and (2) an independent evaluator to test the pilots’ effectiveness.

The article notes that to be eligible for one of the grants, a state’s pilot program must:

- take place in urban and rural areas;

- target people with limited work experience or skills;

- appear easy to replicate in other jurisdictions; and

- test various strategies, such as job training and assistance, and child care subsidies.

According to the article, “[t]he farm bill specifically calls for testing both mandatory and voluntary employment and training programs.”

States must submit their applications by November 14, 2014.

September 19, 2014

Inheriting Digital Assets

Starting January 1, 2015, Delaware residents may pass on their emails, social networking accounts, digital photos, and other digital assets to their heirs. According to an ABC News article, they may do so under Delaware’s Fiduciary Access to Digital Assets and Digital Accounts Act (HB 345), which makes Delaware the first state to pass such a comprehensive law addressing the inheritance of digital assets.

Under the act, “digital assets” include data, text, emails, documents, audio, video, images, sounds, social media content, social networking content, codes, computer source codes, computer programs, software, software licenses, or databases, including the usernames and passwords, created, generated, sent, communicated, shared, received, or stored by electronic means on a digital device.

Connecticut’s law addressing a decedent’s digital assets applies only to email accounts (CGS § 45a-334a).

The act was backed by the Uniform Law Commission, a nonprofit organization that, according to its website, “provides states with nonpartisan, well conceived, and well drafted legislation that brings clarity and stability to critical areas of state statutory law.” The article quotes a commission official who stated that inheritance laws regarding digital assets need updating because:

- digital assets are replacing tangible assets,

- documents are being stored in electronic files rather than file cabinets, and

- photographs are uploaded to websites rather than printed on paper.

Under the act, “digital assets” include data, text, emails, documents, audio, video, images, sounds, social media content, social networking content, codes, computer source codes, computer programs, software, software licenses, or databases, including the usernames and passwords, created, generated, sent, communicated, shared, received, or stored by electronic means on a digital device.

Connecticut’s law addressing a decedent’s digital assets applies only to email accounts (CGS § 45a-334a).

Homes with Smoke-Free Policies Nearly Double Since 1993

Across the country, 83% of households reported as having smoke-free policies in 2010-2011, up from 43% in 1992-1993. This is according to a recent report from the Centers for Disease Control and Prevention (CDC), analyzing data from a U.S. Census survey. The report considered a home to be smoke-free if all adult survey respondents “reported that no one was allowed to smoke (cigarettes) anywhere inside the home at any time.”

The report found that 91.4% of households without adult smokers were smoke-free in 2010-2011 (up from 56.7% in 1992-1993). In households with at least one adult smoker, the prevalence of smoke-free rules increased from 9.6% to 46.1% across this same period.

The share of smoke-free homes in Connecticut was 84.6% in 2010-2011, slightly above the national average.

The CDC report, citing a report from the Surgeon General, states that exposure to secondhand smoke from cigarettes leads to an estimated 41,000 deaths annually among nonsmoking adults.

The report found that 91.4% of households without adult smokers were smoke-free in 2010-2011 (up from 56.7% in 1992-1993). In households with at least one adult smoker, the prevalence of smoke-free rules increased from 9.6% to 46.1% across this same period.

The share of smoke-free homes in Connecticut was 84.6% in 2010-2011, slightly above the national average.

The CDC report, citing a report from the Surgeon General, states that exposure to secondhand smoke from cigarettes leads to an estimated 41,000 deaths annually among nonsmoking adults.

September 18, 2014

Earthquake Damage Is Not Standardly Covered

On August 24, 2014, California’s Napa Valley region experienced a 6.0 magnitude earthquake, the strongest quake to hit the San Francisco Bay area in almost 25 years. The earthquake destroyed homes in various neighborhoods, ruptured water and gas lines, and injured at least 120 people, according to the Insurance Information Institute’s (III) latest issues brief.

Standard homeowners or business insurance policies in the United States do not cover damage caused by earthquakes. But insurers typically offer earthquake coverage in the form of a policy endorsement for an additional premium. The III notes that insurers who do not sell earthquake insurance may still be impacted by earthquakes. For example, customers could file claims for losses due to fire caused by a quake, business interruption, and additional living expenses.

The III highlights several statistics about earthquakes, including:

Standard homeowners or business insurance policies in the United States do not cover damage caused by earthquakes. But insurers typically offer earthquake coverage in the form of a policy endorsement for an additional premium. The III notes that insurers who do not sell earthquake insurance may still be impacted by earthquakes. For example, customers could file claims for losses due to fire caused by a quake, business interruption, and additional living expenses.

The III highlights several statistics about earthquakes, including:

- The United States has about 20,000 earthquakes per year, and 42 states are at risk for them, according to the U.S. Geological Survey.

- Insured losses from earthquakes were about $45 million in 2013, down from $54 billion in 2011 (the year of the 9.0 earthquake in Japan), according to Swiss Re.

Feds Appear to be Moving Slowly on Vehicle Safety Complaints

The Associated Press (AP) reports that the federal agency tasked with monitoring vehicle safety has taken longer than it should to respond to formal requests to investigate possible problems. It reached this conclusion after reviewing 15 petitions filed with the National Highway Traffic Safety Administration (NHTSA) since 2010. The review found that NHTSA 12 times missed the statutory four-month deadline for granting or denying a request.

According to the AP, cars owners can ask NHTSA to act by filing a complaint, which is usually based on a single incident or submitting a formal request for an investigation of possible vehicle safety problems.

“Everything is just really slow,” the executive director of the North Carolina Consumers Council, told the AP. “You have to ask, is everything going as efficiently as it can?” The council filed a petition in 2012 asking NHTSA to look into Nissan truck transmission failures.

More recent criticism concerns NHTSA’ handling of General Motors’ delayed recall of cars with defective ignition switches. NHTSA acknowledged to the AP that it has missed deadlines, but denied that it was dragging its feet, claiming that it needs more than the law allows for examining petitions. “Most [petitions] do not provide sufficient data for NHTSA to evaluate the issues raised without further data collection and analysis,” NHSTA stated.

A New York Times article discusses NHTSA and the GM safety defects.

According to the AP, cars owners can ask NHTSA to act by filing a complaint, which is usually based on a single incident or submitting a formal request for an investigation of possible vehicle safety problems.

“Everything is just really slow,” the executive director of the North Carolina Consumers Council, told the AP. “You have to ask, is everything going as efficiently as it can?” The council filed a petition in 2012 asking NHTSA to look into Nissan truck transmission failures.

More recent criticism concerns NHTSA’ handling of General Motors’ delayed recall of cars with defective ignition switches. NHTSA acknowledged to the AP that it has missed deadlines, but denied that it was dragging its feet, claiming that it needs more than the law allows for examining petitions. “Most [petitions] do not provide sufficient data for NHTSA to evaluate the issues raised without further data collection and analysis,” NHSTA stated.

A New York Times article discusses NHTSA and the GM safety defects.

September 17, 2014

Double SNAP at the Farmers Market

Supplemental Nutrition Assistance Program (SNAP) benefits go twice as far at New Haven farmers markets when used to purchase fruits and vegetables. Such SNAP-based incentive programs (SBIP) may be funded and managed by private foundations, nonprofit organizations, or local governments.

The United States Department of Agriculture (USDA) has taken a closer look at these types of programs in a report released this year. The report did not seek to evaluate the programs, which are not funded by USDA. Instead, it focused on how SBIPs are administered. Findings include:

The United States Department of Agriculture (USDA) has taken a closer look at these types of programs in a report released this year. The report did not seek to evaluate the programs, which are not funded by USDA. Instead, it focused on how SBIPs are administered. Findings include:

- Most of the organizations funding a SBIP do so as part of a larger mission. A majority of funders allocated 25% or less of their total budget to the SBIP.

- Implementing a SBIP is a collaborative process and many of the organizations involved play multiple roles.

- Organizations reported some funding and staffing challenges.

- SNAP fraud is not considered a major issue in implementing SBIPs.

Hot Report: State Barber Licensure Requirements

OLR Report 2014-R-0214 answers the question: What are barber licensure requirements in Connecticut and other states?

OLR Report 2014-R-0199 also describes Connecticut’s barber and hairdresser licensure requirements.

Connecticut barbers must obtain a biennial license from the Department of Public Health (DPH)(CGS Chapter 387). Generally, initial applicants must have successfully completed (1) eighth grade or passed an equivalency exam and (2) at least 1,000 hours of study in an approved barber school. They must also pass a DPH-prescribed exam and pay a $100 fee.

According to the U.S. Department of Labor’s Bureau of Labor Statistics, all states require barbers to obtain a state license. Alabama was the last state to do so beginning in 2013. Previously, the state had not regulated barbers for over 30 years, except for five of its 67 counties (Baldwin, Jefferson, Lauderdale, Madison, and Mobile), which implemented their own barber licensing systems.

Licensure requirements vary by state, but generally, an individual must (1) be at least age 16 or 17, (2) obtain a high school diploma or equivalent, (3) successfully complete training at a state-approved barber or cosmetology school, (4) pass a practical examination, and (5) pay licensing and examination fees.

Some states, such as California, Connecticut, and Kentucky issue a single barber license (Cal. Bus. & Prof. Code §§ 7301-7414 and KRS Chapter 317). Others, such as Massachusetts and Maryland offer different levels of licensure, including apprentice, barber, and “master barber” licenses (Md. Business Occupations and Professions Code Ann. §§ 4-101 et. seq.). With respect to training requirements, some states, such as Alabama, Georgia, Hawaii, and Pennsylvania allow applicants to complete an apprenticeship under a licensed barber in lieu of completing a course of study at a barber or cosmetology school. California and Louisiana offer two-year, state-administered barber apprenticeship programs.

For more information, read the full report.

OLR Report 2014-R-0199 also describes Connecticut’s barber and hairdresser licensure requirements.

Connecticut barbers must obtain a biennial license from the Department of Public Health (DPH)(CGS Chapter 387). Generally, initial applicants must have successfully completed (1) eighth grade or passed an equivalency exam and (2) at least 1,000 hours of study in an approved barber school. They must also pass a DPH-prescribed exam and pay a $100 fee.

According to the U.S. Department of Labor’s Bureau of Labor Statistics, all states require barbers to obtain a state license. Alabama was the last state to do so beginning in 2013. Previously, the state had not regulated barbers for over 30 years, except for five of its 67 counties (Baldwin, Jefferson, Lauderdale, Madison, and Mobile), which implemented their own barber licensing systems.

Licensure requirements vary by state, but generally, an individual must (1) be at least age 16 or 17, (2) obtain a high school diploma or equivalent, (3) successfully complete training at a state-approved barber or cosmetology school, (4) pass a practical examination, and (5) pay licensing and examination fees.

Some states, such as California, Connecticut, and Kentucky issue a single barber license (Cal. Bus. & Prof. Code §§ 7301-7414 and KRS Chapter 317). Others, such as Massachusetts and Maryland offer different levels of licensure, including apprentice, barber, and “master barber” licenses (Md. Business Occupations and Professions Code Ann. §§ 4-101 et. seq.). With respect to training requirements, some states, such as Alabama, Georgia, Hawaii, and Pennsylvania allow applicants to complete an apprenticeship under a licensed barber in lieu of completing a course of study at a barber or cosmetology school. California and Louisiana offer two-year, state-administered barber apprenticeship programs.

For more information, read the full report.

Malnourished Seniors Fly Under the Radar

According to a recent NPR article, malnourishment among seniors often goes undetected until they go to the emergency room seeking medical treatment for injuries or other reasons.

The article cites an August 12th Annals of Emergency Medicine (AEM) study, which found 60% of 138 seniors who visited an emergency room in 2013 were either at-risk for or experiencing malnutrition. NPR notes existing studies estimate six percent of seniors living independently are malnourished, with rates increasing up to 85% for those living in hospitals and long-term care facilities.

Seniors participating in the AEM study cited several reasons for under-eating, including depression, medical and dental issues, and difficulty buying groceries.

Study authors note the importance of identifying at-risk seniors so that they can be referred to local nutrition programs, such as Meals-on-Wheels or food pantries.

Feeding America, a nonprofit hunger-relief organization, designates seniors as the one of the most “food insecure” populations, as approximately one-third of recurrent food bank clients are age 60 or older.

The article cites an August 12th Annals of Emergency Medicine (AEM) study, which found 60% of 138 seniors who visited an emergency room in 2013 were either at-risk for or experiencing malnutrition. NPR notes existing studies estimate six percent of seniors living independently are malnourished, with rates increasing up to 85% for those living in hospitals and long-term care facilities.

Seniors participating in the AEM study cited several reasons for under-eating, including depression, medical and dental issues, and difficulty buying groceries.

Study authors note the importance of identifying at-risk seniors so that they can be referred to local nutrition programs, such as Meals-on-Wheels or food pantries.

Feeding America, a nonprofit hunger-relief organization, designates seniors as the one of the most “food insecure” populations, as approximately one-third of recurrent food bank clients are age 60 or older.

September 16, 2014

Student Loan Debt an Issue for Some Seniors

The recent recession prompted many older workers to return to school to retrain for a new career, but a possible consequence is that these older workers will take on student loan debt that lasts into the traditional retirement years. According to a report by the Government Accountability Office (GAO) the amount of student loan debt held by borrowers age 65 and older increased significantly in the past eight years, from $2.8 billion in 2005 to $18.2 billion in 2013.

This figure is a small fraction of aggregate student loan debt for all borrowers, which GAO estimated to be more than $1 trillion in 2013. However, the debt held by borrowers age 65 and older increased at a much faster rate between 2005 and 2013 than did the amount held by all borrowers.

GAO also found that borrowers age 65 and older were much more likely than younger borrowers to default on their student loans. According to GAO, 27% of student loans held by people ages 65-74 were in default, and 54% of such loans held by borrowers age 75 and older were in default. This compares with a 12% default rate for borrowers ages 25-49.

One possible consequence of default is an offset of Social Security payments. GAO found that about 36,000 people age 65 and older had their Social Security benefits offset in 2013 to pay student loan debt, compared with about 6,000 such people in 2002.

This figure is a small fraction of aggregate student loan debt for all borrowers, which GAO estimated to be more than $1 trillion in 2013. However, the debt held by borrowers age 65 and older increased at a much faster rate between 2005 and 2013 than did the amount held by all borrowers.

GAO also found that borrowers age 65 and older were much more likely than younger borrowers to default on their student loans. According to GAO, 27% of student loans held by people ages 65-74 were in default, and 54% of such loans held by borrowers age 75 and older were in default. This compares with a 12% default rate for borrowers ages 25-49.

One possible consequence of default is an offset of Social Security payments. GAO found that about 36,000 people age 65 and older had their Social Security benefits offset in 2013 to pay student loan debt, compared with about 6,000 such people in 2002.

Construction Begins on New Veterans Memorial

|

| Source: CTHonorsVets.org |

The memorial will honor both the fallen veterans and the more than 277,000 living veterans in the state.

Although the official groundbreaking ceremony was held in April 2013, the project had various delays.

September 15, 2014

Protecting Yourself from Rabies

Twice in recent weeks attacks by rabid wildlife made Connecticut’s news headlines: first when a raccoon attacked an 88-year old Hamden woman in her home, and second when a bobcat attacked a Bozrah woman.

The Department of Public Health’s (DPH) Epidemiology and Emerging Infections Program complies statistics on rabies, but testing wild animals for the disease is limited, occurring only when they come in contact with people or domestic animals. According to DPH data, between January 1, 2014 and July 31, 2014, there were 72 confirmed cases of rabid animals in Connecticut. The infected animals included bats, cats, foxes, groundhogs/woodchucks, raccoons, skunks, and one sheep. Raccoon infection occurred most often — 45 out of the 72 total cases.

The Department of Energy and Environmental Protection cautions people to minimize rabies exposure by: (1) vaccinating pets and livestock; (2) avoiding contact with wild and stray animals; and (3) if exposed to rabies, washing the exposed area and immediately contacting medical personnel.

The Department of Public Health’s (DPH) Epidemiology and Emerging Infections Program complies statistics on rabies, but testing wild animals for the disease is limited, occurring only when they come in contact with people or domestic animals. According to DPH data, between January 1, 2014 and July 31, 2014, there were 72 confirmed cases of rabid animals in Connecticut. The infected animals included bats, cats, foxes, groundhogs/woodchucks, raccoons, skunks, and one sheep. Raccoon infection occurred most often — 45 out of the 72 total cases.

The Department of Energy and Environmental Protection cautions people to minimize rabies exposure by: (1) vaccinating pets and livestock; (2) avoiding contact with wild and stray animals; and (3) if exposed to rabies, washing the exposed area and immediately contacting medical personnel.

Hot Report: Comparison of Charter, Magnet, and Innovation Schools

OLR Report 2014-R-0218 compares the state laws and funding for three types of public schools: charter schools, interdistrict magnet schools, and innovation schools. (This updates OLR Report 2011-R-0001.)

Table 1 in the report compares the statutory provisions governing approval, programs, students, special education, and transportation requirements for each type of school. It also shows how each school is funded. The definition for each type follows.

Table 1 in the report compares the statutory provisions governing approval, programs, students, special education, and transportation requirements for each type of school. It also shows how each school is funded. The definition for each type follows.

- A charter school is a public, nonsectarian, nonprofit school established under a charter that operates independently of any local or regional board of education, provided no member or employee of a governing council of a charter school shall have a personal or financial interest in the assets, real or personal, of the school (charters are granted by the State Board of Education (SBE) or by a local board and the SBE) (CGS § 10-66aa).

- An interdistrict magnet school is a school designed to promote racial, ethnic, and economic diversity that draws students from more than one school district and offers a special or high quality curriculum and requires students to attend at least half time (magnets are operated by school districts, regional education service centers (RESCs), or other entities) (CGS § 10-264l(a)).

- An innovation school is a school that a local or regional school district chooses to operate under an innovation plan developed by district leaders or by an external partner for the purpose of improving school performance or student achievement (CGS § 10-74h(a)).

Most Undocumented Immigrant Children Temporarily Placed In a Handful of Counties

According to a recent Washington Post article, “[o]f the tens of thousands of undocumented immigrant children apprehended this year, nearly four in five of those temporarily released have been sent to a small share of counties…” The article notes that when children are captured at the border, the government initially cares for them and then releases them to family members or other sponsors while awaiting immigration proceedings.

Of the 126 counties nationwide in which more than 50 undocumented immigrant children were placed with sponsors from January through July 2014, three are located in Connecticut. Of these counties, Fairfield County received the most children (253), followed by New Haven (66), and Hartford (53). Harris County, Texas received the most children overall (2,866.)

The map below from the Washington Post displays counties around the country with more than 50 undocumented children. The Post also created an interactive version of the map.

Of the 126 counties nationwide in which more than 50 undocumented immigrant children were placed with sponsors from January through July 2014, three are located in Connecticut. Of these counties, Fairfield County received the most children (253), followed by New Haven (66), and Hartford (53). Harris County, Texas received the most children overall (2,866.)

The map below from the Washington Post displays counties around the country with more than 50 undocumented children. The Post also created an interactive version of the map.

|

| Source: Washington Post |

September 12, 2014

Prizes for Voting?

According to Governing, the Los Angeles Ethics Commission recently voted to recommend that the City Council consider offering cash prizes (using a lottery system) to boost voter turnout at municipal elections. Voter turnout at municipal elections is notoriously low across the country and Los Angeles is no exception where it is commonly falls below 20 or 25%. But the commission’s vote came on the heels of a special school board election in which fewer than 10% of registered voters came out to vote.

Prior to the Ethics Commission’s recommendation, city political leaders had been looking at ways to increase turnout and considered, among other things, holding municipal elections in even-numbered years with state and federal elections, which consistently draw out more voters. Noting that a transition to such a system could take several years to implement, the commission suggested a lottery system—starting with a pilot program. Federal law prohibits people from accepting payment in exchange for voting, but according to the Los Angeles ethics commissioner, that statute would not apply in an election where there are no federal positions on the ballot.

Prior to the Ethics Commission’s recommendation, city political leaders had been looking at ways to increase turnout and considered, among other things, holding municipal elections in even-numbered years with state and federal elections, which consistently draw out more voters. Noting that a transition to such a system could take several years to implement, the commission suggested a lottery system—starting with a pilot program. Federal law prohibits people from accepting payment in exchange for voting, but according to the Los Angeles ethics commissioner, that statute would not apply in an election where there are no federal positions on the ballot.

Report: Childhood Traumatic Events Have Long-Lasting Effect

A July report by Child Trends, a nonprofit children’s research group, found that children exposed to potentially traumatic events (i.e., adverse childhood experiences or ACEs) are at increased risk of poor health and illnesses as adults.

The report analyzed survey responses from more than 95,000 adults about children in their households. They found that just under half of all children in the U.S. had experienced at least one ACE, but that their prevalence varies widely among states.

The study found economic hardship to be the most ACE experienced by children in almost all states, followed by parents’ divorce or separation. Other ACEs reported included (1) living with someone who was mentally ill, depressed, or suicidal for more than a couple of weeks or abused substances and (2) exposure to neighborhood violence.

The study found that Connecticut and New Jersey have some of the lowest rates nationally for ACEs, while Oklahoma had some of the highest rates.

The report analyzed survey responses from more than 95,000 adults about children in their households. They found that just under half of all children in the U.S. had experienced at least one ACE, but that their prevalence varies widely among states.

The study found economic hardship to be the most ACE experienced by children in almost all states, followed by parents’ divorce or separation. Other ACEs reported included (1) living with someone who was mentally ill, depressed, or suicidal for more than a couple of weeks or abused substances and (2) exposure to neighborhood violence.

The study found that Connecticut and New Jersey have some of the lowest rates nationally for ACEs, while Oklahoma had some of the highest rates.

September 11, 2014

Feeling Underemployed?

According to Payscale.com, 43% of respondents to a recent survey consider themselves “underemployed” which, in the survey’s definition, includes (1) feeling underpaid, (2) having a job that doesn’t use the respondent’s education, training, and skills, or (3) working part-time but wanting full-time work. Being underpaid was the most common reason, with 80% of those who identified as underemployed citing it. Interestingly, Payscale found that 45% of those who said they were underpaid “were actually paid in line with the market for their current position.”

Among various occupations, 87% of the surveyed patient services representatives reported feeling underemployed, the most of any occupational category, followed by nannies (78%), and retail sales associates (78%). Underemployed respondents who felt that they were not using their education or training were most prevalent among data entry operators (38%) and administrative technicians (36%) and general office clerks (36%). Those working part-time who wanted full-time work were most common among orderlies (39%), retail sales associates (36%), and line cooks (35%).

Payscale.com is an online salary and compensation information company that, among other things, surveys and compiles employee job profile and compensation data and provides compensation consulting services to employers.

Among various occupations, 87% of the surveyed patient services representatives reported feeling underemployed, the most of any occupational category, followed by nannies (78%), and retail sales associates (78%). Underemployed respondents who felt that they were not using their education or training were most prevalent among data entry operators (38%) and administrative technicians (36%) and general office clerks (36%). Those working part-time who wanted full-time work were most common among orderlies (39%), retail sales associates (36%), and line cooks (35%).

Payscale.com is an online salary and compensation information company that, among other things, surveys and compiles employee job profile and compensation data and provides compensation consulting services to employers.

Hot Report: Institutionally Related Foundations for New England Public Universities

OLR Report 2014-R-0214 answers the questions: How does the relationship between UConn and the UConn foundation compare with other New England flagship public universities and their foundations? Specifically:

- are these foundations exempt from their respective states’ Freedom of Information (FOI) laws,

- are they the primary fundraising entities for their respective universities, and

- how much money have they raised for their universities over the past five years?

Additionally, how much did in-state tuition and fees increase in the past five years at these universities?

To answer these questions, OLR examined the foundations of the six New England flagship public universities:

- UConn Foundation,

- University of Maine (UMaine) Foundation,

- University of Massachusetts (UMass) Amherst Foundation,

- University of New Hampshire (UNH) Foundation,

- University of Rhode Island (URI) Foundation, and

- University of Vermont (UVM) Foundation.

Connecticut is the only New England state that explicitly exempts public university foundations from state FOI laws. The other New England states’ FOI laws generally do not address university foundations specifically. Most of these foundations serve as their related institution’s primary fundraising arm, with the UConn Foundation having the highest fundraising revenues of these foundations.

Concerning tuition, UConn had the (1) third-lowest in-state tuition and fee increase among these universities for the academic years 2008-09 through 2013-14 and (2) highest percentage increase from 2012-13 to 2013-14.

Fighting Financial Crimes Against Seniors

“In 2013, the Federal Trade Commission’s Consumer Sentinel Network database contained 123,757 fraud complaints from victims who identified themselves as age 60 or older.” A PEW Charitable Trusts’ Stateline magazine article cites this as evidence that financial fraud against seniors is a substantial problem.

Financial crimes against seniors are committed by relatives, caregivers, or strangers and, per the article, the fraudulent activity includes:

- misuse of credit cards;

- unauthorized ATM transactions; and

- deception to open joint accounts, sign away deeds, or give power of attorney.

According to the article, 28 states introduced legislation in 2014 to address this issue. These states have considered measures that focus on enhancing criminal penalties, targeting caregivers, and requiring financial institutions to report suspected fraud. The article highlights the following laws passed in three states over the past two years:

- the comprehensive senior protection bill passed in Colorado that requires police officers to be trained to recognize the exploitation of at-risk seniors;

- legislation in Maryland that requires money transmitters to train employees to recognize and respond to financial exploitation of seniors (already required for financial institutions); and

- a 2013 North Carolina law that gives courts authority to freeze the assets of those charged with the financial exploitation of seniors.

September 10, 2014

Second Circuit Decision on Super PACs

In recent years, courts around the country have generally held that government cannot limit contributions to political action committees that make independent expenditures only (i.e., Super PACs). But in a recent case, (Vermont Right to Life, Inc. v. Sorrell (2014 WL 2958565)), the Second Circuit Court of Appeals held that contribution limits are permissible if the Super PAC is not functionally distinct from an entity that engages in activities other than independent expenditures (e.g., a “traditional” PAC that makes contributions to candidates).

In the case, Vermont Right to Life (VRLC) challenged, among other things, a Vermont law that limits contributions made to PACs, arguing that it should not apply to a Super PAC that VRLC controls. However, VRLC has both a Super PAC and a traditional PAC, and the Second Circuit, affirming an earlier U.S. District Court decision, found that VRLC’s Super PAC was “enmeshed financially and organizationally” with its traditional PAC. Thus, the Super PAC was subject to the state’s contribution limits.

The court held that VRLC needed to show actual organizational separation between the PAC and the Super PAC; having separate bank accounts and stating in organizational documents that a group was a Super PAC was not enough. The court stated that factors measuring organizational separation could include overlap of staff and resources, degree of financial independence, coordination of activities, and flow of information between the entities.

In the case, Vermont Right to Life (VRLC) challenged, among other things, a Vermont law that limits contributions made to PACs, arguing that it should not apply to a Super PAC that VRLC controls. However, VRLC has both a Super PAC and a traditional PAC, and the Second Circuit, affirming an earlier U.S. District Court decision, found that VRLC’s Super PAC was “enmeshed financially and organizationally” with its traditional PAC. Thus, the Super PAC was subject to the state’s contribution limits.

The court held that VRLC needed to show actual organizational separation between the PAC and the Super PAC; having separate bank accounts and stating in organizational documents that a group was a Super PAC was not enough. The court stated that factors measuring organizational separation could include overlap of staff and resources, degree of financial independence, coordination of activities, and flow of information between the entities.

Nationwide, More People Living in “Poverty Areas”

Earlier this summer, the U.S. Census Bureau issued a report on changes in poverty areas (i.e., census tracts with poverty rates of 20% or more) from 2000-2010. According to the report, the number of people living in poverty areas increased from 18.1% in 2000 to 25.7% in 2010. This increase followed a 1.9% decrease from 1990-2000.

The report also provides state- and region-specific data. From 2000 to 2010, the percentage of people living in poverty areas increased by (1) 3.3% in the Northeast and (2) 4.2% in Connecticut. During the same period, the percentage of people in poverty living in such areas increased by (1) 3.8% in the Northeast and (2) 6.9% in Connecticut.

The report notes that the increase in poverty concentration places additional burdens on low-income families: “Problems associated with living in poverty areas, such as, higher crime rates, poor housing conditions, and fewer job opportunities are exacerbated when poor families live clustered in high-poverty neighborhoods.”

The report also provides state- and region-specific data. From 2000 to 2010, the percentage of people living in poverty areas increased by (1) 3.3% in the Northeast and (2) 4.2% in Connecticut. During the same period, the percentage of people in poverty living in such areas increased by (1) 3.8% in the Northeast and (2) 6.9% in Connecticut.

The report notes that the increase in poverty concentration places additional burdens on low-income families: “Problems associated with living in poverty areas, such as, higher crime rates, poor housing conditions, and fewer job opportunities are exacerbated when poor families live clustered in high-poverty neighborhoods.”

September 9, 2014

Hot Report: UConn Student Code Violations

OLR Report 2014-R-0222 answers the questions: What are the possible sanctions for conduct violating UConn’s Student Code? How many times has UConn imposed each sanction in the last five academic years and for which offenses?

UConn’s Student Code contains standards, rules, and regulations to which all UConn students and organizations must adhere. It contains four primary sanctions: warning, probation, suspension, and expulsion. UConn may also impose secondary sanctions in conjunction with the primary sanctions, including loss of privileges, removal from student housing, restitution, and participation in educational programming.

Under the code, sanctions may be imposed, individually or in various combinations, against any student found to have violated it. The code, with certain exceptions, generally does not provide any guidelines for sanctions that are tied to specific offenses. According UConn’s Office of Community Standards, which administers the code, any violation may result in a suspension or expulsion, depending on the case’s factors and individual circumstances.

Tables 3 and 4 in th report list the number of times that UConn imposed each type of primary and secondary sanction, respectively, in the previous five academic years. Tables 5 and 6 provide additional details about suspensions and expulsions, respectively, including the offenses that led to these sanctions. The data, which are from reports by UConn’s Office of Community Standards, do not list the offenses that resulted in other types of sanctions (e.g., warnings or probation).

For more information, read the full report.

UConn’s Student Code contains standards, rules, and regulations to which all UConn students and organizations must adhere. It contains four primary sanctions: warning, probation, suspension, and expulsion. UConn may also impose secondary sanctions in conjunction with the primary sanctions, including loss of privileges, removal from student housing, restitution, and participation in educational programming.

Under the code, sanctions may be imposed, individually or in various combinations, against any student found to have violated it. The code, with certain exceptions, generally does not provide any guidelines for sanctions that are tied to specific offenses. According UConn’s Office of Community Standards, which administers the code, any violation may result in a suspension or expulsion, depending on the case’s factors and individual circumstances.

Tables 3 and 4 in th report list the number of times that UConn imposed each type of primary and secondary sanction, respectively, in the previous five academic years. Tables 5 and 6 provide additional details about suspensions and expulsions, respectively, including the offenses that led to these sanctions. The data, which are from reports by UConn’s Office of Community Standards, do not list the offenses that resulted in other types of sanctions (e.g., warnings or probation).

For more information, read the full report.

Older Pedestrians Are At Higher Risk for Fatal Accidents

Older pedestrians are more likely to be killed in a vehicular accident than younger pedestrians according to a new study from Tri-Star Transportation Campaign (TSTC), a non-profit advocacy organization dedicated to reducing car dependency in New York, New Jersey, and Connecticut. The study shows that while those 60 and older make up 19% of the state’s population, they were 35% of the state’s victims of fatal accidents. The difference is even greater when looking at people 75 and older: they are 7% of the state’s population but 17% of the pedestrian fatalities.

Between 2003 and 2012, the statewide pedestrian fatality rate for those (1) aged 60 and older was 1.84 per 100,000 people and (2) younger than 60 was 0.79 per 100,000 people.

Nationally, the 60-and-older rate is 2.23 per 100,000 and the younger-than-60 rate is 1.40 per 100,000.

Between 2003 and 2012, the statewide pedestrian fatality rate for those (1) aged 60 and older was 1.84 per 100,000 people and (2) younger than 60 was 0.79 per 100,000 people.

Nationally, the 60-and-older rate is 2.23 per 100,000 and the younger-than-60 rate is 1.40 per 100,000.

September 8, 2014

State Legislatures Jump Into Common Core Arena

The National Council for State Legislatures has teamed up with Education Week to track legislative activity related to the Common Core State Standards (CCSS). They found that in the past year and a half, 22 legislatures have introduced a total of 50 bills seeking to change the way educational standards are developed, reviewed, and adopted. Many of the bills died in committee, but others advanced through one or both chambers. Ten states have enacted laws that restrict state board adoption of curriculum standards.

In the majority of states (over 40, including Connecticut), elected or appointed state boards of education have sole authority over academic standards. In other states, it lies with the state superintendent or education commissioner, or is shared among a variety of entities (e.g., state board, commissioner, department of education, legislature).

The recently introduced bills sought broader legislative input into standards decisions, transfers of state boards’ power over standards to legislatures or panels with legislative input, and new processes for adopting academic standards, among other things. Education Week has a detailed breakdown of laws passed and bills pending in Indiana, Michigan, Missouri, North Carolina, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, and Utah.

In the majority of states (over 40, including Connecticut), elected or appointed state boards of education have sole authority over academic standards. In other states, it lies with the state superintendent or education commissioner, or is shared among a variety of entities (e.g., state board, commissioner, department of education, legislature).

The recently introduced bills sought broader legislative input into standards decisions, transfers of state boards’ power over standards to legislatures or panels with legislative input, and new processes for adopting academic standards, among other things. Education Week has a detailed breakdown of laws passed and bills pending in Indiana, Michigan, Missouri, North Carolina, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, and Utah.

Supreme Court Term in Review

The Legal Information Institute (LII) at Cornell Law School recently completed its review of the U.S. Supreme Court’s 2013-2014 term, highlighting the term’s most important and controversial cases. The review notes that 45 of 70 cases were decided 9-0. Eleven were decided 5-4.

The review discusses several First Amendment cases; three Fourth Amendment cases; and several other cases concerning topics such as affirmative action, the separation of powers, and copyright law.

Two other sources for analysis of the term’s significant cases are panel discussions moderated by organizations generally perceived to be on opposite ends of the ideological spectrum: (1) the American Constitution Society for Law and Policy (a progressive organization) and (2) the Heritage Foundation (a conservative think tank).

The review discusses several First Amendment cases; three Fourth Amendment cases; and several other cases concerning topics such as affirmative action, the separation of powers, and copyright law.

Two other sources for analysis of the term’s significant cases are panel discussions moderated by organizations generally perceived to be on opposite ends of the ideological spectrum: (1) the American Constitution Society for Law and Policy (a progressive organization) and (2) the Heritage Foundation (a conservative think tank).

September 5, 2014

Connecticut Experiences Decrease in Spending on Prisoner Health Care

Connecticut decreased per-inmate spending on prisoner health care by 4% from 2007 to 2011, according to a report from the Pew Charitable Trust and the MacArthur Foundation. The drop, from $5,430 to $5,211 (in inflation-adjusted 2011 dollars), came during a period when state per-inmate health care spending increased by a median of 10% nationally.

The report points to the following factors that cause an increase in per-inmate spending:

Total spending on prison health care has decreased, too, by 10%. Connecticut’s prison population has decreased by 6%.

The report points to the following factors that cause an increase in per-inmate spending:

- "The distance of prisons from hospitals and other providers.

- The prevalence of infectious and chronic diseases, mental illness, and substance use disorder among inmates.

- An aging inmate population.”

Total spending on prison health care has decreased, too, by 10%. Connecticut’s prison population has decreased by 6%.

Kids Eating More Fruit, Still Saying “No” to Veggies

According to the federal Centers for Disease Control and Prevention (CDC), the amount of whole fruit children age 2-18 consume increased by 67% from 2003 to 2010. (“Whole fruit” includes fruit that is fresh, frozen, canned, or dried; it does not include juice.) Even with this surge in popularity, six out of 10 children did not eat enough fruit from 2007 to 2010. Perhaps not surprisingly, vegetables were even less popular; nine out of 10 children did not eat enough vegetables during that time period.

Of the vegetables children ate from 2009 to 2010, about 1/3

were white potatoes, and nearly 2/3 (63%) of those potatoes were fried (e.g., French fries) or potato chips.

To increase children’s fruit and vegetable intake, the CDC recommends that parents:

1. eat fruit and vegetables with their children;

2. involve them in shopping, growing, and preparing fruits and vegetables; and

3. learn what counts as a cup of fruit and vegetables (e.g., eight large strawberries or 12 baby carrots).

|

| Source: USDA, www.ChooseMyPlate.gov |

were white potatoes, and nearly 2/3 (63%) of those potatoes were fried (e.g., French fries) or potato chips.

To increase children’s fruit and vegetable intake, the CDC recommends that parents:

1. eat fruit and vegetables with their children;

2. involve them in shopping, growing, and preparing fruits and vegetables; and

3. learn what counts as a cup of fruit and vegetables (e.g., eight large strawberries or 12 baby carrots).

September 4, 2014

Could Our Power Plants Flood?

The federal Energy Information Administration (EIA) maintains an informative tool called the U.S. Energy Mapping System. The maps show the location of energy infrastructure across the country. Users can activate and disable various layers of the maps to show the locations of power plants, refineries, pipelines, and more.

Recently, the EIA has added data from the Federal Emergency Management Agency to create the “Flood Vulnerability Assessment Map”. This map shows where energy infrastructure is at risk of flooding.

The image above is a screenshot of the map zoomed to an area south of Bridgeport. The map shows a coal power plant ( ) and a natural gas power plant (

) and a natural gas power plant ( ), as well as three petroleum product terminals (

), as well as three petroleum product terminals ( ). The light blue shading in these areas indicates a flood hazard zone, specifically a one-percent annual chance flood hazard. This means that the area is subject to flooding during a flood that has a one-percent chance of being equaled or exceeded in any given year (also known as a 100-year flood).

). The light blue shading in these areas indicates a flood hazard zone, specifically a one-percent annual chance flood hazard. This means that the area is subject to flooding during a flood that has a one-percent chance of being equaled or exceeded in any given year (also known as a 100-year flood).

Recently, the EIA has added data from the Federal Emergency Management Agency to create the “Flood Vulnerability Assessment Map”. This map shows where energy infrastructure is at risk of flooding.

|

| Source: EIA |

) and a natural gas power plant (

) and a natural gas power plant ( ), as well as three petroleum product terminals (

), as well as three petroleum product terminals ( ). The light blue shading in these areas indicates a flood hazard zone, specifically a one-percent annual chance flood hazard. This means that the area is subject to flooding during a flood that has a one-percent chance of being equaled or exceeded in any given year (also known as a 100-year flood).

). The light blue shading in these areas indicates a flood hazard zone, specifically a one-percent annual chance flood hazard. This means that the area is subject to flooding during a flood that has a one-percent chance of being equaled or exceeded in any given year (also known as a 100-year flood).

Hot Report: Required Data in the Public School Information System

OLR Report 2014-R-0220 describes the types of data that must be included in the Public School Information System (PSIS) and includes the appropriate statutory references.

PSIS contains data related to each K-12 student and teacher in Connecticut public schools. State law requires the State Department of Education (SDE) to develop and implement PSIS to (1) establish a standardized electronic data collection and reporting protocol to comply with state and federal reporting requirements, (2) improve the exchange of information from school-to-school and district-to-district, and (3) maintain the confidentiality of individual student and teacher data (CGS § 10-10a(b)).

SDE’s Data Collection Guide requires districts to submit two types of data to PSIS:

- data specifically included in the PSIS enabling statute and