…claim

Standard and Poor’s economists (

How Increasing Income Inequality is Dampening U.S. Economic Growth, and Possible Ways to Change the Tide). That may not be news to many academic economists who pour over income and demographic figures looking for patterns and trends on how income is distributed throughout society and what it means for the economy.

But business economists, like S&P’s, are a different matter. As the

New York Times’ Neil Irwin put it:

…the new S&P report is a sign of how worries that income inequality is a factor behind subpar economic growth over the last five years (and really the last 15 years) is going from an idiosyncratic argument made mainly by left-of-center economists to something that even the tribe of business forecasters needs to wrestle with.

After all, business forecasters are paid to advise business officials about what’s around the next bend, including potential changes in people’s spending habits (which also affect tax revenue flows). Those habits figure into S&P’s take on why the economy isn’t kicking into high gear. In summing up S&P’s findings, Irwin wrote:

Because the affluent tend to save more of what they earn rather than spend it, as more and more of the nation’s income goes to people at the top income brackets, there isn’t enough demand for goods and services to maintain strong growth, and attempts to bridge the gap with debt feed a boom-bust cycle of crisis….

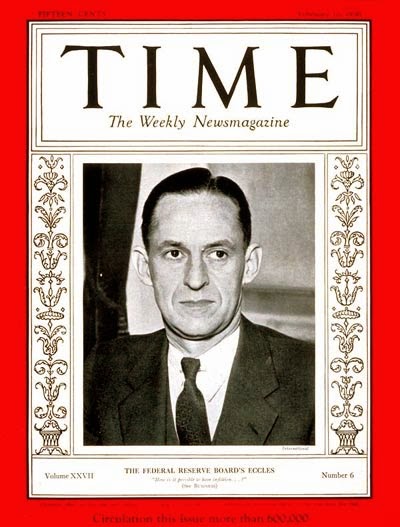

Marriner Eccles, a tycoon and former Federal Reserve governor, made a similar case in 1950 when he looked back over his days making money in the 1920s and regulating the nation’s money supply in the 1930s and 1940s. Eccles “understood the economy from the ground up,” wrote Berkeley public policy professor and former Clinton administration labor secretary Robert B. Reich, in

Aftershock: The Next Economy and America’s Future (2010). “He saw how average people responded to economic downturns, and how his customers reacted to the deep crisis at hand. He merely connected the dots.” During the Great Depression, Eccles didn’t see how lower prices and interest rates would spur new investment if people didn’t have the money to buy things. According to Reich, Eccles wrote that “[s]uch investments take place in a climate of high prosperity, when the purchasing power of the masses increases their demands more than their bare wants.”